Real Estate Agent

Purchasing a home can be exciting as well as scary. However, I am here to give you some tips that will ease your fears and concerns when buying property in the near future.

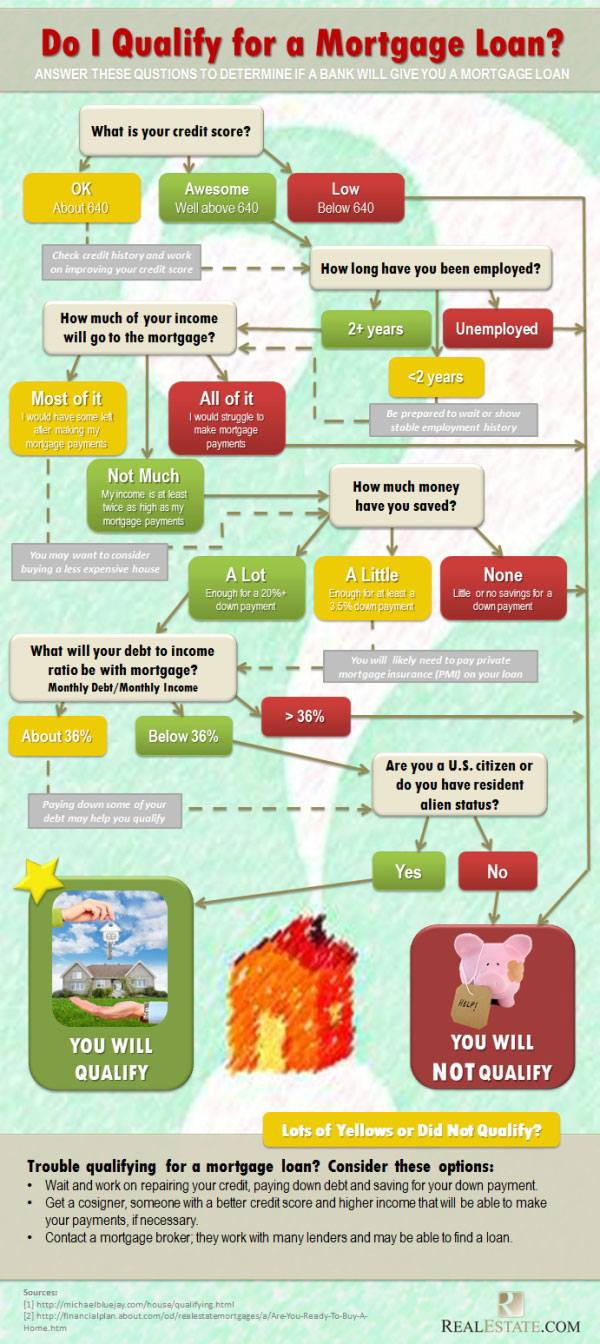

Are You Qualified To Buy?

|

This is the number one question when it comes to purchasing real estate, even if you're paying cash. I'll tell you exactly why in just a few minutes...

Like most buyers who are applying for a home loan, you have to make sure, first and foremost, that you are "credit worthy". While there are SOME lenders who take a deeper look into WHY your score is the way it is, most DO NOT. To take advantage of the best deals right now, your credit score needs to be at least 640. BUT that is just the beginning. The next thing you need to consider is HOW MUCH DEBT you already have. This is a big one because you can have an 800 credit score, but your Debt-To-Income Ratio is at 75%. What exactly does that mean? 75% of your income is going on debt and you only have 25% to spend on everything else (housing, utilities, insurance, etc.). So it's not hard to see why a lender would quickly deny your application with an 800 score. The third thing that a lot of buyers have had trouble with is the down payment amount. Now, this varies greatly due to credit scores, loan products, and down payment assistance programs. Depending on your situation, you may have to bring anywhere between 3.5%-20% down in order to close on your new home. Is this affordable for you? Are you in a position to bring this amount to the closing table? Cash buyers have a few concerns too. The main question that you must answer is: "Will I be house-rich, but cash-poor after purchasing this home?" Will you have enough to purchase other needs and wants in life once this cash is used for the home? Do you have more enough income on hand to pay for the taxes and insurance monthly and/or annually? Please let me make this very clear: PAYING FOR YOUR HOME IN CASH IS AWESOME! I've worked with and personally know several people who have done this and they are more than happy that all they have to pay for are the taxes and insurance. Contact me if you are looking to buy a home in NC immediately or within the next few months. I can give advice on either financing a home or finding great deals on cash purchases. Need help boosting your credit score or down payment assistance? No problem. I have lots of resources to share with you that will help you purchase your new home! We specialize in helping renters become homeowners.

|

Need A Loan?

Are You A First Time Home Buyer? Not Sure You Qualify For A Home Loan While In Bankruptcy? Are You A Service Member Or Veteran? Give Us A Call! We Have SEVERAL Programs To Help With Every Situation!

|

Steven Vick

919-747-7933 [email protected] Serving Raleigh, Wake, Johnston, and Surrounding Counties Specializing in Community-Based Financing, First Time Home Buyer Programs, Borderline Credit and Streamlined Refinancing |

Rodney Debro

919-908-1924 [email protected] Serving The Durham, Triangle, and Triad Areas Specializing In Bankruptcies, Credit-Specific Financing, & Manufactured Homes |

Teresa M. Parker

919-697-2598 [email protected] Serving Fayetteville/Fort Bragg, Cumberland & Lee Counties & The Sandhills Specializing in VA Loans in NC and GA |

Photos from investmentzen, investmentzen, cafecredit