Real Estate Agent

Home Buyers Guide: A Step By Step Guide To Buying Your Next Home

Introduction

The Home Buyers Guide was written with the first time home buyer in mind. It is a guide that will help them move through the home buying process with a better understanding of how the real estate industry works and how to be an informed consumer during this process. But there are many useful tips and strategies that can be used by any home buyer whether it is their first time or fifth time purchasing a home.

The Home Buyers Guide has been set up as a reference guide that can be referred as a buyer works their way through the complex transaction. But unlike other guides that have a long laundry list of items to consider without the needed emphasis in certain areas, this guide will highlight those things that are most important to consider when buying a home. The guide will also show how to avoid those things that could potentially make the purchase of your new home a financial disaster.

The Home Buyers Guide was written as a general reference guide and is educational in nature. It does not cover local guidelines, legal issues and other prevailing conditions that might be specific to your situation or location.

The Home Buyers Guide was written with the first time home buyer in mind. It is a guide that will help them move through the home buying process with a better understanding of how the real estate industry works and how to be an informed consumer during this process. But there are many useful tips and strategies that can be used by any home buyer whether it is their first time or fifth time purchasing a home.

The Home Buyers Guide has been set up as a reference guide that can be referred as a buyer works their way through the complex transaction. But unlike other guides that have a long laundry list of items to consider without the needed emphasis in certain areas, this guide will highlight those things that are most important to consider when buying a home. The guide will also show how to avoid those things that could potentially make the purchase of your new home a financial disaster.

The Home Buyers Guide was written as a general reference guide and is educational in nature. It does not cover local guidelines, legal issues and other prevailing conditions that might be specific to your situation or location.

|

Chapter 1 - Financing the Purchase

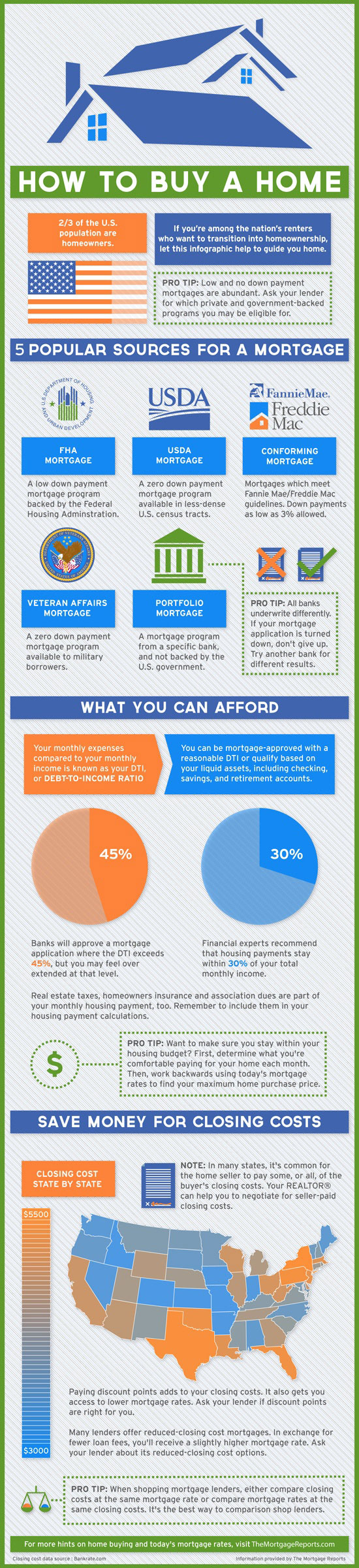

Most people put the cart before the horse when it comes to buying a home. They start looking at houses first and only when they have traveled far down the road do they consider the financial aspects of the transaction. This is fine and good if you have a lot of money and an established banking relationship and understand all the different financial considerations that you have to make when buying a new home. For first time home buyers this is a terrible way to start. Shopping for homes without an understanding of your finances and your options is like going to a fancy restaurant without knowing how much available credit you have on your credit card. You get to the restaurant and look at the menu. And you see the steaks and lobster and other dishes being brought out to the other tables and your mouth starts to water. Then you pick out your entree. And then when you have all your side dishes and desserts picked out you step outside to call your credit card company to see how much money you have available. This is how most people go about buying a house. They go online and look at all the houses. They look at the pictures and virtual tours. They go to a bunch of open houses on a warm sunny Sunday. They get sick of the place they are living and begin to dream of a new home. Maybe they have even found the "perfect home" during their search. And they have only done some very basic financial analysis and they have no idea how much they can afford or how much they will qualify to borrow or how much they need to have in cash to buy a new home. Don't be these people!!! Once you start looking on line or even think about buying a home, you need to look at your financial picture and get a clear understanding of how much house you will realistically be able to buy. Here are the main components you need to consider regarding the financing of a home purchase. Credit

A clear understanding of your credit report and credit score will be absolutely vital to making a home purchase. A good credit score will allow you to finance more home because you will be able to get a lower interest rate. Also, a higher credit score might get you into a more favorable loan program. This could mean a lower down payment or other more favorable terms. By finding out your credit score early in the process you can take action if the score isn't as high as you want or need. There are many ways to improve your score prior to getting a loan. You can order your credit report from the three different credit reporting agencies or you can have a loan officer run your report as part of the application process. A good loan officer will sometimes act as a credit adviser. They will run your credit for no charge and be able to tell you what you can do to improve your credit report in the eyes of their bank. This is extremely valuable information. If you have a loan officer that doesn't provide this service then you should probably look for another lender. Down Payment and Closing Costs Almost all loans programs will require a minimum down payment amount in order to secure the loan. There once was a time where 100% financing was readily available but the mortgage crisis put an end to those programs. An FHA loan will require a down payment amount of at least 3.5% of the purchase price. Add that to the typical closing costs needed in your state (about 3% in Virginia) and you will have a pretty good idea of the cash you will need to buy a home. In some cases it will be possible to get closing costs assistance from the seller of the property. What that entails is building into the contract an amount that the seller will give you at settlement from their proceeds. Depending on the market conditions and local practice that can be anywhere from 1% to 3% of the sales price. A good real estate agent will be able to tell you what you could possible get in closing costs in your market. However, it is better to plan on getting no closing cost assistance and if you are able to get it than it will be a bonus. Monthly Payment Calculations How much you can afford to pay on a monthly basis can be a very tricky calculation. The lending industry uses a ratio to determine how much of your monthly income should go toward your mortgage payments. This is usually around 28% to 31% of your gross monthly income. That is a good place to start but it is too overly simplistic. Another way that first time home buyers will estimate their monthly payment is by comparing it to their current rental payment. This is also too simplistic. There are additional expenses that go along with homeownership that should be factored into your calculations. And on the other hand, there are potential tax deductions that could potentially reduce the amount you owe state and federal governments that should also be considered. You can use a mortgage calculator to figure out a monthly payment amount for the amount of loan you will need to purchase a house. This will include principal and interest. You will also need to know the state and local real estate taxes on the property. This is usually a percentage of the assessed value and can be found on the government website or by asking a local real estate professional. Also, you will want to factor in the homeowners insurance as well as any homeowners association due and/or condo dues. One thing overlooked by most first time buyers is the cost of actually maintaining a home. There will be various repairs and expenses throughout the year that need to be budgeted for. A good estimate for these maintenance costs is 1% of the value of the home per year. Barring any large repairs, major system replacements or remodeling projects, this should be a good number to use. |

Pre-Approval and Pre-Qualification Letters

Once you have spoken to a couple of lenders (yes, you should talk to at least 2) and you are comfortable with what they have told you regarding your financing situation, you need to get them to write you a letter saying that you can secure financing and buy a house. This letter will accompany any offer you submit and will give the listing agent an idea of just how strong your financial situation is. The stronger the letter the better the chance of getting the deal. The stronger the lender you are using, the better the chance of getting the deal. There are two types of letters, a Pre-Approval Letter and a Pre-Qualification Letter. The Pre-Approval letter is not as strong a a Pre-Qualification Letter. It is usually written by the loan officer you are working with and says that based on credit and preliminary numbers, you will be able to get financing. The Pre-Qualification Letter says that based on verification of credit, income, assets, employment, etc. you will be able to finance a specific dollar amount. If you have done the first step completely, you will be able to get a Pre-Qualification Letter from the loan officer. And when you submit your offer you should be able to reference the strength of the letter to the listing agent. Also, if you don't have a real estate agent, you can use this letter as proof you can afford to buy a house and that he or she will not be wasting their time driving around to houses you do not qualify for. And because of this, you could qualify for rebates and cashback programs that some brokerages give to highly qualified buyers. |

|

Chapter 2 - List of Requirements

Now that you know what you qualify to buy, you need to write down those qualities of a home that are important to you and just how important they are. This will allow you to focus your search on areas that match your criteria and not get distracted and lose focus. A loss of focus at the beginning of a search will cause you to waste a lot of time as well as get confused as to what is important and what is not. Buyers who skip this step will spend several months driving around and looking at houses without any clear idea what they really want. This will eventually lead to them seeing homes that will be sold by the time they get focused. This causes them to compare ever house that is for sale to the "perfect house" that is already sold and they can no longer buy. This will lead to further confusion and second guessing. This step is crucial in making sure you don't miss out on the "perfect home". Also remember that unless you build it yourself, you will never find the "perfect home". You will only find the almost perfect house that will eventually become the perfect home. Must Haves This is the list of items that you home must have no matter what. This list should include items outside of the house as well as those items that must be present inside the house. This list should not include items that are superficial in nature such as color of the walls, flooring, landscaping and other things that can easily be changed once you move in. It should definitely include the lot, location, distance for commuting, schools, bedrooms, garage, etc. These are things that cannot be easily changed and should be carefully considered. Would Like to Have Once you have the must haves, you can now make a list of the things you would really like to have. These are going to be the things that you really would like to have but if they aren't there, they won't be a deal breaker. This list should be pretty long and you should rank everything on the list on a scale of 1-5 of importance. You want to find a house that has most of the higher ranked items. You will also be able to price in some of the things that aren't in the house to give you an idea of what it will cost to make the house as close to perfect as possible. This list will also get everyone on the same page in terms of what to look for in the houses that will match the must have criteria that you have already established. This list will be a great tool to keep your search focused and not waste too much time on less important items. |

|

Chapter 3 - Search for Homes

Now that you have your list you can start looking for homes. Bear in mind that the lists you created in the previous step are not written in stone and once you start actually searching for homes that meet your criteria, you might have to rethink and repriortize your lists. Search the Internet Over the last couple of years the internet has become a great resource for homes. You can now search online and find most of the listings that at one time only agents had access to. This allows you to spend a lot of time searching for homes in the convenience of your home. You can find multiple high resolution pictures of most homes. You can get satellite views of the street and see exactly what the home backs up to. There are vast amounts of data about the neighborhoods. And there are tremendous amounts of data about prices and values. |

Your Agent as a Resource

Although the reliance on the agent to find a home has dropped off significantly because of the internet, they are still an valuable tool for finding houses that you might not be able to find or have overlooked. They also have access to data that is much more accurate and timely than almost all internet sites.

You can send them links to houses that you like and get their opinion. This will also allow them to see what you like and make suggestions and send you listings that they think you might like. And because the market is fluid and houses come on the market everyday, it is good to have another set of eyes looking for the perfect home for you.

Also, agents can use the database of information in the MLS that is not public and analyze prices and market activity that is invaluable to finding a good value or recognizing changing conditions.

Viewing Homes

By this time you should have a pretty good idea if you can get the house you want for the price you can afford. The internet will have saved you plenty of time avoiding hours driving around looking at homes that don't meet your criteria. And you should have your agent in the loop on houses that you like. At this point you should have your agent preview any houses that might meet your criteria but the information available on line was insufficient to really tell if it is a good prospect or not. This is an invaluable service that good agents perform for their clients.

After your agent has previewed the houses you like and other houses that might be good, set up a time to look at the best 5-7 homes. Have your agent set this up for a 2-3 hour block of time. This is the most homes you want to look at in one trip because any more and the properties start to run together and you get mixed up as to what house had what features. Also, when you go house touring do not bring your kids because they will only distract you from the task at hand.

If you have done the preliminary searches and your agent has done the previewing you will only need to see 10-12 houses at the most. This means it should take you two outings to find the right house. If, however, you do not have that many to choose from, after the initial outing, you will have to set the alerts for new listings and go visit them one by one as soon as they come on the market. You should also trust that after seeing 8 or more homes you will have a very good idea of value and will be able to pick the best house for your new home.

Although the reliance on the agent to find a home has dropped off significantly because of the internet, they are still an valuable tool for finding houses that you might not be able to find or have overlooked. They also have access to data that is much more accurate and timely than almost all internet sites.

You can send them links to houses that you like and get their opinion. This will also allow them to see what you like and make suggestions and send you listings that they think you might like. And because the market is fluid and houses come on the market everyday, it is good to have another set of eyes looking for the perfect home for you.

Also, agents can use the database of information in the MLS that is not public and analyze prices and market activity that is invaluable to finding a good value or recognizing changing conditions.

Viewing Homes

By this time you should have a pretty good idea if you can get the house you want for the price you can afford. The internet will have saved you plenty of time avoiding hours driving around looking at homes that don't meet your criteria. And you should have your agent in the loop on houses that you like. At this point you should have your agent preview any houses that might meet your criteria but the information available on line was insufficient to really tell if it is a good prospect or not. This is an invaluable service that good agents perform for their clients.

After your agent has previewed the houses you like and other houses that might be good, set up a time to look at the best 5-7 homes. Have your agent set this up for a 2-3 hour block of time. This is the most homes you want to look at in one trip because any more and the properties start to run together and you get mixed up as to what house had what features. Also, when you go house touring do not bring your kids because they will only distract you from the task at hand.

If you have done the preliminary searches and your agent has done the previewing you will only need to see 10-12 houses at the most. This means it should take you two outings to find the right house. If, however, you do not have that many to choose from, after the initial outing, you will have to set the alerts for new listings and go visit them one by one as soon as they come on the market. You should also trust that after seeing 8 or more homes you will have a very good idea of value and will be able to pick the best house for your new home.

|

Chapter 4 - Making an Offer

So you have found a house and now it is time to write an offer and submit it to the sellers agent. This is where your agent and the resources available to him or her will be extremely valuable. It will also be important that your agent knows the current market trends and makes you aware of those trends before putting together and offer. Sales Price to List Price Ratio You want to submit an offer that has a price that can be supported by recent sales, current inventory and price trends. You don't want to put an offer in that is too low and does not even get a response back from the sellers and at the same time you don't want to go too high and pay too much for a house. A good starting point to use is the list price to sales price ratio of completed sales. A good agent can tell you what price a home sold for and compare that to the final list price of the home. In a strong sellers market this number is close to or in some cases above 100%. That means buyers are paying full price or bidding houses over list price. In these market conditions it is important to know this ahead of time so you don't get discouraged putting in offers that never get accepted by the sellers. In a buyers market when there is plenty of inventory this ratio can get down closer to 93 or 94%. This means that buyers are offering well below list price and negotiating to a number in between. In a balanced market this number is usually around 97%. This means that a buyer can offer around 94 or 95% of list price and get the seller to accept less than full list. |

Days on Market

But you can't use the sale price to list price ratio by itself. You must also consider how long the house has been on the market. A house that is new on the market will probably have home owners that are less likely to take an offer significantly below the list price. In most cases they will counter at full list price or not at all if they feel the offer is low. They will do this because they will assume that if someone likes the house enough to put an offer in when it first hits the market that others will follow and hopefully they will have a better offer to consider. And the opposite holds true. A home that has been on the market longer than other homes in the same area should expect to get lower offers. Either that or the seller should adjust their price until they receive an offer that reflects market conditions. At which time a buyer that has been following the home waiting for the price reduction will then step in and offer a price more reflective of the averages. |

Contingencies

There are certain contingencies that you can put into a contract that protect one party or the other. These contingencies provide protection for one party while increasing risk for the other party. An informed and professional agent will be able to tell you what contingencies are commonplace and will not cause the sellers to balk at your offer as well as which contingencies will most certain never be accepted by the other party. This information is extremely valuable to know before you write an offer and submit it.

An example of a contingency is for financing. This provides the buyer a certain amount of time to secure the commitment from the bank that they will in fact lend you the money on the house you have selected. This gives a buyer time to complete the loan approval process and gives the bank time to value the property on which it will be lending you money. Almost all sellers will allow this type of contingency. Other types of contingencies that protect the buyer are Inspection Contingencies, Appraisal Contingencies, Sale of Home Contingencies. Ask your agent which ones they recommend and how they will protect your and for how long.

Settlement Date Selection

This is usually a date 3 to 6 weeks into the future that represents a time that both you and the sellers can sit down at a settlement table and sign the documents that transfers ownership to you. Try to avoid the last couple of days of the month because it is very busy for lenders and settlement offices and delays are almost expected at those times. Also, avoid Fridays if possible because a slight delay on the bank's part in getting the funding completed could push the settlement to the following day and that will be Monday if Friday was the target day.

There are certain contingencies that you can put into a contract that protect one party or the other. These contingencies provide protection for one party while increasing risk for the other party. An informed and professional agent will be able to tell you what contingencies are commonplace and will not cause the sellers to balk at your offer as well as which contingencies will most certain never be accepted by the other party. This information is extremely valuable to know before you write an offer and submit it.

An example of a contingency is for financing. This provides the buyer a certain amount of time to secure the commitment from the bank that they will in fact lend you the money on the house you have selected. This gives a buyer time to complete the loan approval process and gives the bank time to value the property on which it will be lending you money. Almost all sellers will allow this type of contingency. Other types of contingencies that protect the buyer are Inspection Contingencies, Appraisal Contingencies, Sale of Home Contingencies. Ask your agent which ones they recommend and how they will protect your and for how long.

Settlement Date Selection

This is usually a date 3 to 6 weeks into the future that represents a time that both you and the sellers can sit down at a settlement table and sign the documents that transfers ownership to you. Try to avoid the last couple of days of the month because it is very busy for lenders and settlement offices and delays are almost expected at those times. Also, avoid Fridays if possible because a slight delay on the bank's part in getting the funding completed could push the settlement to the following day and that will be Monday if Friday was the target day.

|

Earnest Money

You will almost certainly have to put money up as good faith deposit when you submit your offer. The amount will vary by jurisdiction and from seller to seller. But you should expect to put up at lease 1% of the offering price. This money will be held in an escrow account. Upon acceptance of the contract and ratification by both parties the earnest money will be held by one of the broker's in the transaction or by an escrow agent. This also depends on the jurisdiction and corresponding laws of the state. If the contract becomes void then the money will be returned. If there is a dispute then this money will sit in the escrow account until the dispute is resolved. If the transaction is completed, the money will be used to offset closing costs and/or down payment. Lender Letter This was mentioned earlier in the financing section. You will now need the letter from your bank saying you are either Pre-Qualified or Pre-Approved. This letter will accompany your offer. |

Chapter 5 - Ratification to Settlement

You made an offer and most likely spent a couple of days going back and forth with the sellers on price, settlement date, contingencies, inspections and other specifics of the contract. But hopefully you have come to a point that you are satisfied with the terms and conditions. The date which all parties have signed off on the contract and all changes is called the ratification date. This begins the clock on all deadlines that must be met including the settlement date.

Now you must begin your due diligence and all the parties to the transaction must begin moving toward a smooth and successful settlement. This is also one of the most critical functions of a good real estate agent. They will help you coordinate with the other parties and communicate with the sellers on the progress as it is made. They should also be able to recommend service providers that can act quickly and professionally.

You made an offer and most likely spent a couple of days going back and forth with the sellers on price, settlement date, contingencies, inspections and other specifics of the contract. But hopefully you have come to a point that you are satisfied with the terms and conditions. The date which all parties have signed off on the contract and all changes is called the ratification date. This begins the clock on all deadlines that must be met including the settlement date.

Now you must begin your due diligence and all the parties to the transaction must begin moving toward a smooth and successful settlement. This is also one of the most critical functions of a good real estate agent. They will help you coordinate with the other parties and communicate with the sellers on the progress as it is made. They should also be able to recommend service providers that can act quickly and professionally.

Home Inspection

One of the most critical contingencies and usually the first one you need to take care of is for the Home Inspection. This will be your opportunity to go through the house from top to bottom with a professional. A good home inspector will walk you through all the systems in the house and show you how they operate. He will recommend repairs. Some repairs will be minor and some will be more critical. He will let you know life expectancy of items in the house like the roof, HVAC system, hot water heater and other appliances.

The goal is to uncover any and all defects with the property so that you know what you are buying. Once you finish the inspection you can do one of three things. Buy the house as it is and ask for no repairs be made. You can ask for certain repairs be made at the seller's expense prior to settlement. Or you can void the contract and buy another home. This last scenario usually occurs when a major defect has been uncovered. This is the main reason you want a professional to do the inspection. Major defects usually require the eye of a trained professional.

Financing, Appraisals and Insurance

In order to get the loan, the bank will require you to provide them with information once you have selected a property you want to buy. Your agent should immediately get a copy of the ratified contract to the loan officer and you should get all the documentation to the loan officer as quickly as possible. The bank will then work to get you a final approval. This final approval will be contingent upon an appraisal. The bank will order this and a third party appraiser will assess the market value of the house.

The bank will also require certain inspection reports as a condition of the loan. A pest inspection is almost mandatory and will uncover termites and other wood destroying insects. If there are wood destroying insects present the house will need to be treated before a loan is approved.

Well and septic inspections are also required by banks. If the house you buy has its own well and septic system then these inspections need to be ordered immediately. Again, another reason to have a good real estate agent is they will have access to the companies that handle these inspections.

The lender will also require you have home owners insurance on the property. This is a good time to get that policy in place.

One of the most critical contingencies and usually the first one you need to take care of is for the Home Inspection. This will be your opportunity to go through the house from top to bottom with a professional. A good home inspector will walk you through all the systems in the house and show you how they operate. He will recommend repairs. Some repairs will be minor and some will be more critical. He will let you know life expectancy of items in the house like the roof, HVAC system, hot water heater and other appliances.

The goal is to uncover any and all defects with the property so that you know what you are buying. Once you finish the inspection you can do one of three things. Buy the house as it is and ask for no repairs be made. You can ask for certain repairs be made at the seller's expense prior to settlement. Or you can void the contract and buy another home. This last scenario usually occurs when a major defect has been uncovered. This is the main reason you want a professional to do the inspection. Major defects usually require the eye of a trained professional.

Financing, Appraisals and Insurance

In order to get the loan, the bank will require you to provide them with information once you have selected a property you want to buy. Your agent should immediately get a copy of the ratified contract to the loan officer and you should get all the documentation to the loan officer as quickly as possible. The bank will then work to get you a final approval. This final approval will be contingent upon an appraisal. The bank will order this and a third party appraiser will assess the market value of the house.

The bank will also require certain inspection reports as a condition of the loan. A pest inspection is almost mandatory and will uncover termites and other wood destroying insects. If there are wood destroying insects present the house will need to be treated before a loan is approved.

Well and septic inspections are also required by banks. If the house you buy has its own well and septic system then these inspections need to be ordered immediately. Again, another reason to have a good real estate agent is they will have access to the companies that handle these inspections.

The lender will also require you have home owners insurance on the property. This is a good time to get that policy in place.

Chapter 6 - Settlement and Post Settlement

The day has come and it is time to sit down at the settlement table and actually buy your new home. You have been in contact with the settlement company, your agent and your loan officer during the whole process so there should be no unpleasant surprises on this day. But you probably had a few moments of anxiety along the way which is typical for a transaction of this magnitude. But those items were worked out and now you can move forward.

Settlement Statement

The settlement statement is a government document that the settlement company uses to reconcile all the money that changes hands at settlement. It is also called a HUD-1. You should get a chance to review a preliminary copy of this document either the day before a settlement or the morning of settlement. Your agent should also review this. This will show all the costs associated with the transaction including lender fees, taxes, escrows, settlement company charges and broker fees. It will have both the buyers costs as well as the sellers costs. It will also have a final amount that you will be required to bring to settlement.

This is a preliminary statement but it shouldn't be too different from the final as long as the lender has given the title company all their required costs. This number should also be close to the number on the Good Faith Estimate.

Final Walk Through

Either the night before or just before settlement you and your agent should do a final walk through of the house. You want to make sure that everything is still in working order, the house is vacant and cleaned up according to the terms of the contract. You also want to make sure nothing is gone from the house that was suppose to stay such as lighting fixtures or appliances. You want to make sure no damage occurred during the moving process. Any problems need to be address immediately with the sellers. Your agent should handle this with the sellers agent.

Settlement Table

The most important thing to bring to settlement is you. And you must prove you are who you say you are so bring identification. All buyers must be present or someone who has the power to sign for them. Arrangements must be made in advance if a buyer or seller will not be physically present at settlement.

Next most important is the funds required to settle. This must be in the form of certified funds such as a cashiers check or money order so make arrangements to have this done prior to settlement.

You will also want to bring any documentation you have accumulated along the way from your lender so that any discrepancies can be resolved. Bring a copy of your insurance policy or proof of payment for the policy. It is a good idea to put everything into a file and bring it to settlement.

Post Settlement

The hard part is now over and best part begins. You now get to enjoy your new home. You should have received keys to the home as well as garage door openers, mail box keys and other items that come along with home ownership. If you purchased a home warranty that will now be in effect and you should keep that information readily handy. All the other documents from the settlement should be carefully filed because you will need them in the future.

You will need your settlement statement when tax time comes around because there are costs on the statement that are tax deductible such as taxes and lender points.

You should continue to use your agent as a resource for real estate related items. The good agents have handymen, painters, deck builders, and other contractors in their list of contacts. And your loan officer will be a great resource when it comes time to refinance.

The day has come and it is time to sit down at the settlement table and actually buy your new home. You have been in contact with the settlement company, your agent and your loan officer during the whole process so there should be no unpleasant surprises on this day. But you probably had a few moments of anxiety along the way which is typical for a transaction of this magnitude. But those items were worked out and now you can move forward.

Settlement Statement

The settlement statement is a government document that the settlement company uses to reconcile all the money that changes hands at settlement. It is also called a HUD-1. You should get a chance to review a preliminary copy of this document either the day before a settlement or the morning of settlement. Your agent should also review this. This will show all the costs associated with the transaction including lender fees, taxes, escrows, settlement company charges and broker fees. It will have both the buyers costs as well as the sellers costs. It will also have a final amount that you will be required to bring to settlement.

This is a preliminary statement but it shouldn't be too different from the final as long as the lender has given the title company all their required costs. This number should also be close to the number on the Good Faith Estimate.

Final Walk Through

Either the night before or just before settlement you and your agent should do a final walk through of the house. You want to make sure that everything is still in working order, the house is vacant and cleaned up according to the terms of the contract. You also want to make sure nothing is gone from the house that was suppose to stay such as lighting fixtures or appliances. You want to make sure no damage occurred during the moving process. Any problems need to be address immediately with the sellers. Your agent should handle this with the sellers agent.

Settlement Table

The most important thing to bring to settlement is you. And you must prove you are who you say you are so bring identification. All buyers must be present or someone who has the power to sign for them. Arrangements must be made in advance if a buyer or seller will not be physically present at settlement.

Next most important is the funds required to settle. This must be in the form of certified funds such as a cashiers check or money order so make arrangements to have this done prior to settlement.

You will also want to bring any documentation you have accumulated along the way from your lender so that any discrepancies can be resolved. Bring a copy of your insurance policy or proof of payment for the policy. It is a good idea to put everything into a file and bring it to settlement.

Post Settlement

The hard part is now over and best part begins. You now get to enjoy your new home. You should have received keys to the home as well as garage door openers, mail box keys and other items that come along with home ownership. If you purchased a home warranty that will now be in effect and you should keep that information readily handy. All the other documents from the settlement should be carefully filed because you will need them in the future.

You will need your settlement statement when tax time comes around because there are costs on the statement that are tax deductible such as taxes and lender points.

You should continue to use your agent as a resource for real estate related items. The good agents have handymen, painters, deck builders, and other contractors in their list of contacts. And your loan officer will be a great resource when it comes time to refinance.