Real Estate Agent

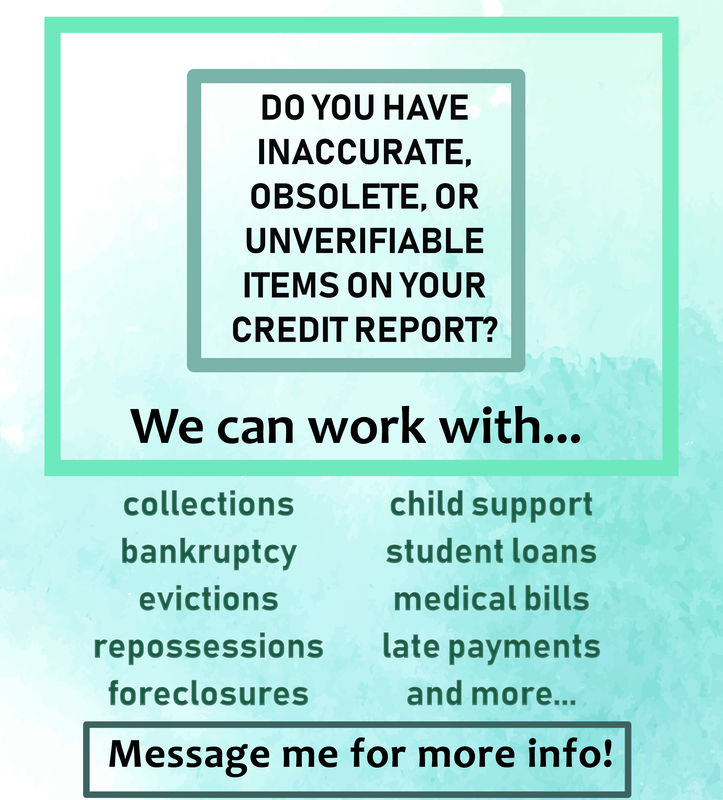

Rebuilding Your credit

It is vitally important for us to know where we stand with our credit report. Sometimes we never know what life may throw at us to require a personal loan, new car, or purchase a home.

Lenders have strict guidelines on who they give money to and for those that have bad credit, there's a whole lot more to prove that you are worthy of receiving the loan.

Not only are the interest rates higher, but there are more hoops to jump through than those who have good credit.

Just because someone has bad credit does not mean they are a bad person. A job loss due to the economy being shut down, a loved one needing medical care, or a personal injury that causes a temporary loss of income throws your credit for a loop.

Life happens, but you can always find a way to make it better. It’s imperative to keep up with your credit and get negative items off of your report so it can stop bringing your credit score down.

These are things that can hinder your dreams of home ownership. As a Realtor, I see and hear the frustration, fear, and hurt that people are going through because of their credit. They feel embarrassed and hopeless that they can’t get the house they truly want because of an "unsatisfactory" credit report.

This doesn't have to be true for you! One of my former clients had low scores and collections, BUT was willing to work on their credit for a few months to raise it. The lender pulled their credit report, the score was above the approval requirement to obtain the loan. It didn’t take long to find a home for the client and we were able to close on their brand new home!

This could be you, but are you willing to do the work?

Contact me to get started!!!

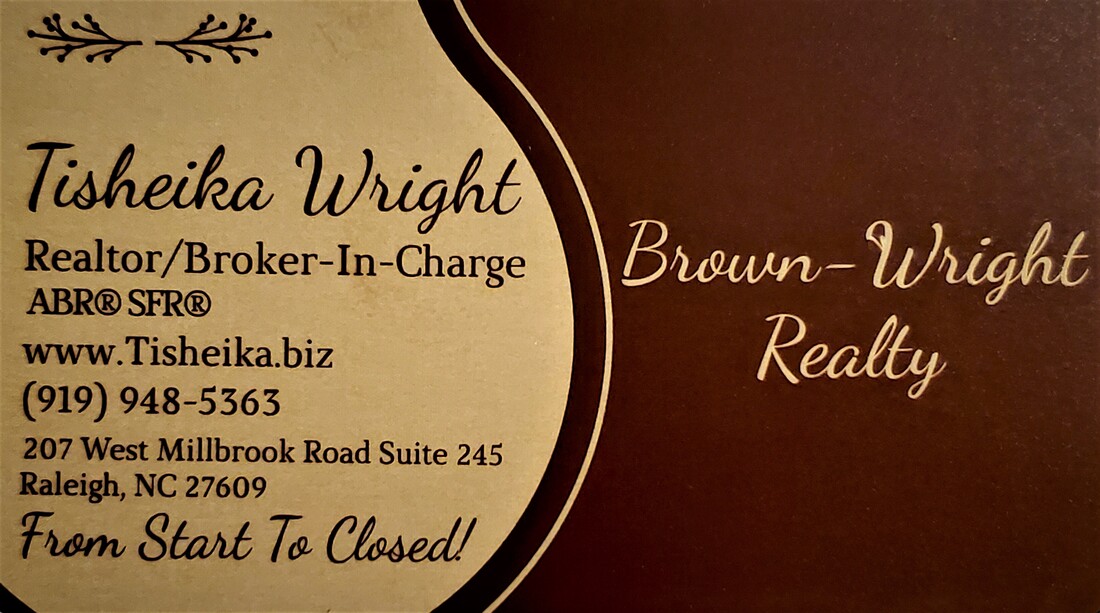

Tisheika Wright

Lenders have strict guidelines on who they give money to and for those that have bad credit, there's a whole lot more to prove that you are worthy of receiving the loan.

Not only are the interest rates higher, but there are more hoops to jump through than those who have good credit.

Just because someone has bad credit does not mean they are a bad person. A job loss due to the economy being shut down, a loved one needing medical care, or a personal injury that causes a temporary loss of income throws your credit for a loop.

Life happens, but you can always find a way to make it better. It’s imperative to keep up with your credit and get negative items off of your report so it can stop bringing your credit score down.

These are things that can hinder your dreams of home ownership. As a Realtor, I see and hear the frustration, fear, and hurt that people are going through because of their credit. They feel embarrassed and hopeless that they can’t get the house they truly want because of an "unsatisfactory" credit report.

This doesn't have to be true for you! One of my former clients had low scores and collections, BUT was willing to work on their credit for a few months to raise it. The lender pulled their credit report, the score was above the approval requirement to obtain the loan. It didn’t take long to find a home for the client and we were able to close on their brand new home!

This could be you, but are you willing to do the work?

Contact me to get started!!!

Tisheika Wright

Photo from EpicTop10.com